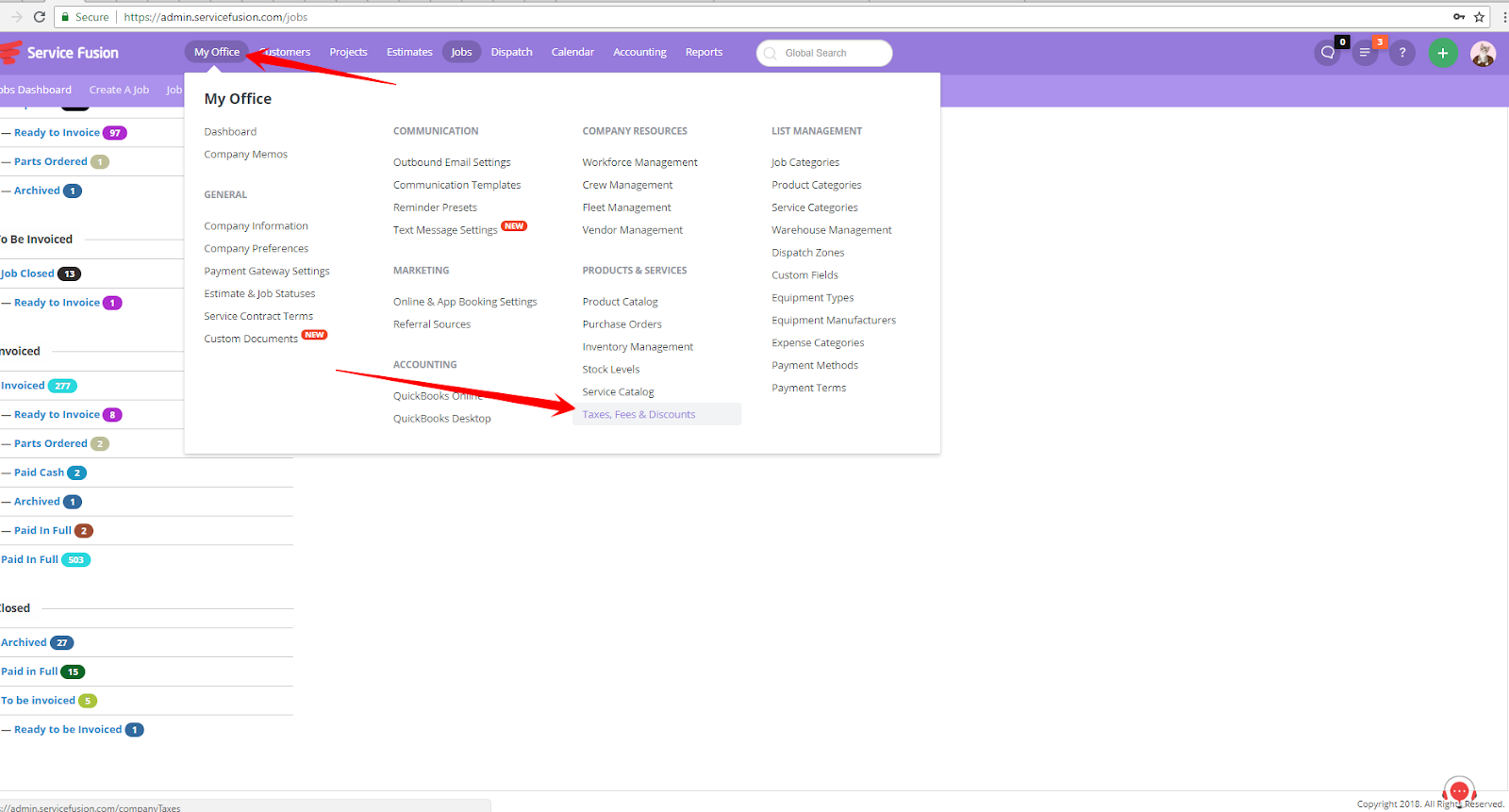

1. ) A bad debt write off is usually needed when an invoice could not be collected and must be written off, usually after year end. This is accomplished by going to Taxes, Fees & Discounts and setting up a discount line item to offset the amount of the invoice. Select My Office and then Taxes, Fees & Discounts.

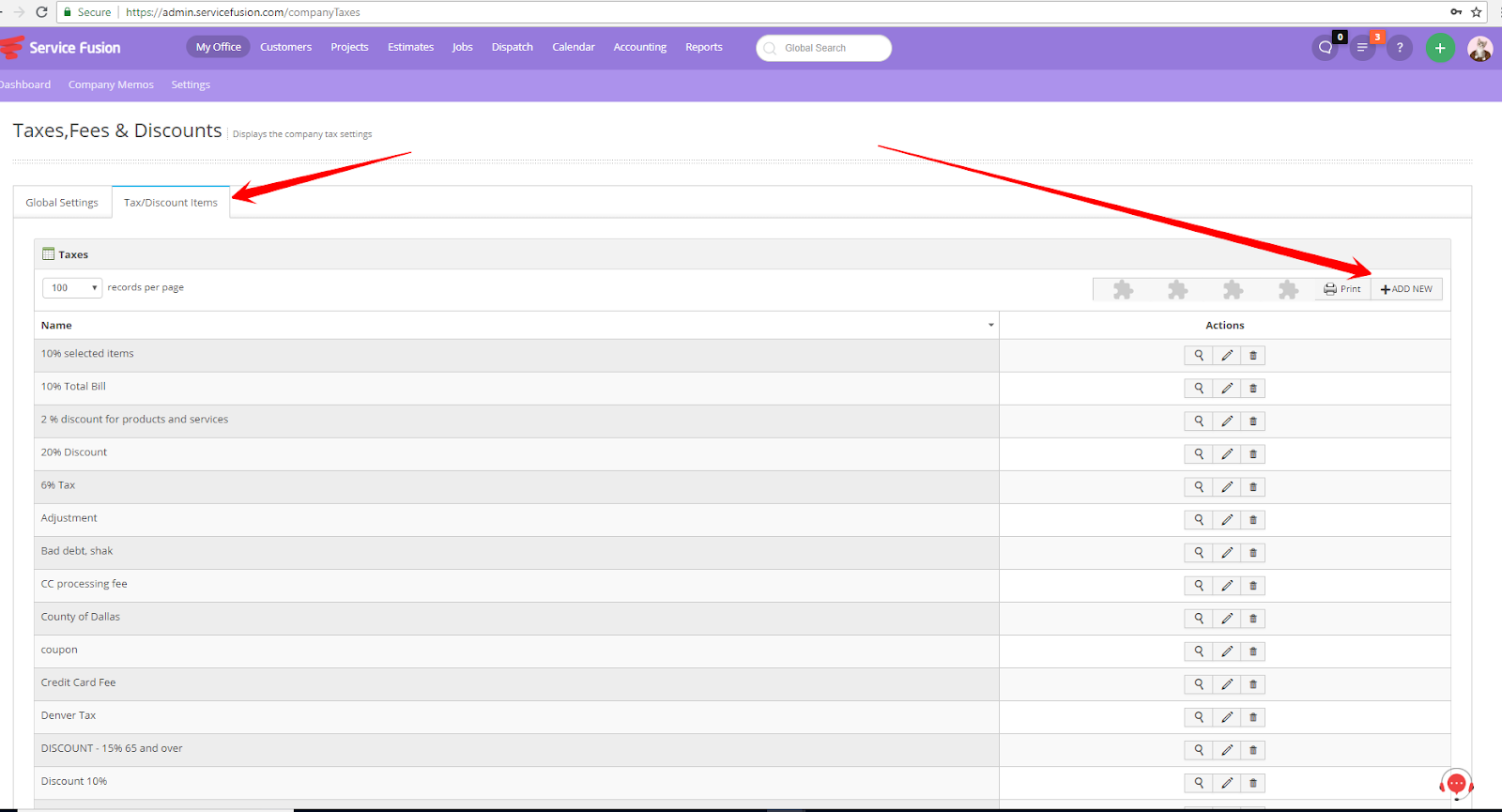

2. ) You can select the Tax/Discount items tab and the Add New button.

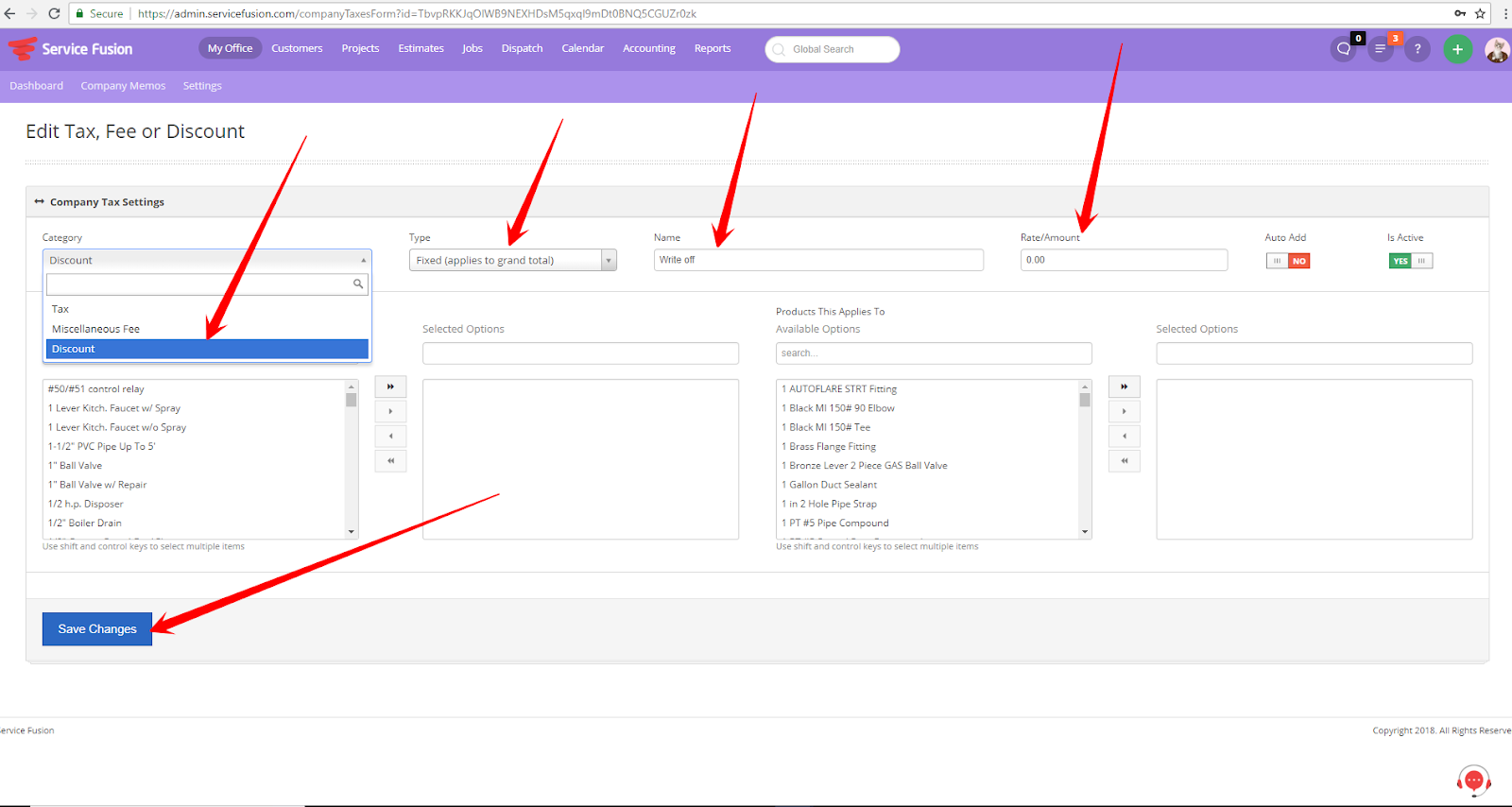

3. ) Select Discount under Category and Fixed (applies to grand total) under Type. Put ‘Write Off’ or ‘Bad Debt’ under Name and you do not need to put an amount under Rate/Amount. Leave Auto Add as ‘no’ and Is Active as ‘yes’. No products or services need to be moved over from the left box to the right box because the line item will apply to the whole invoice. Select Save.

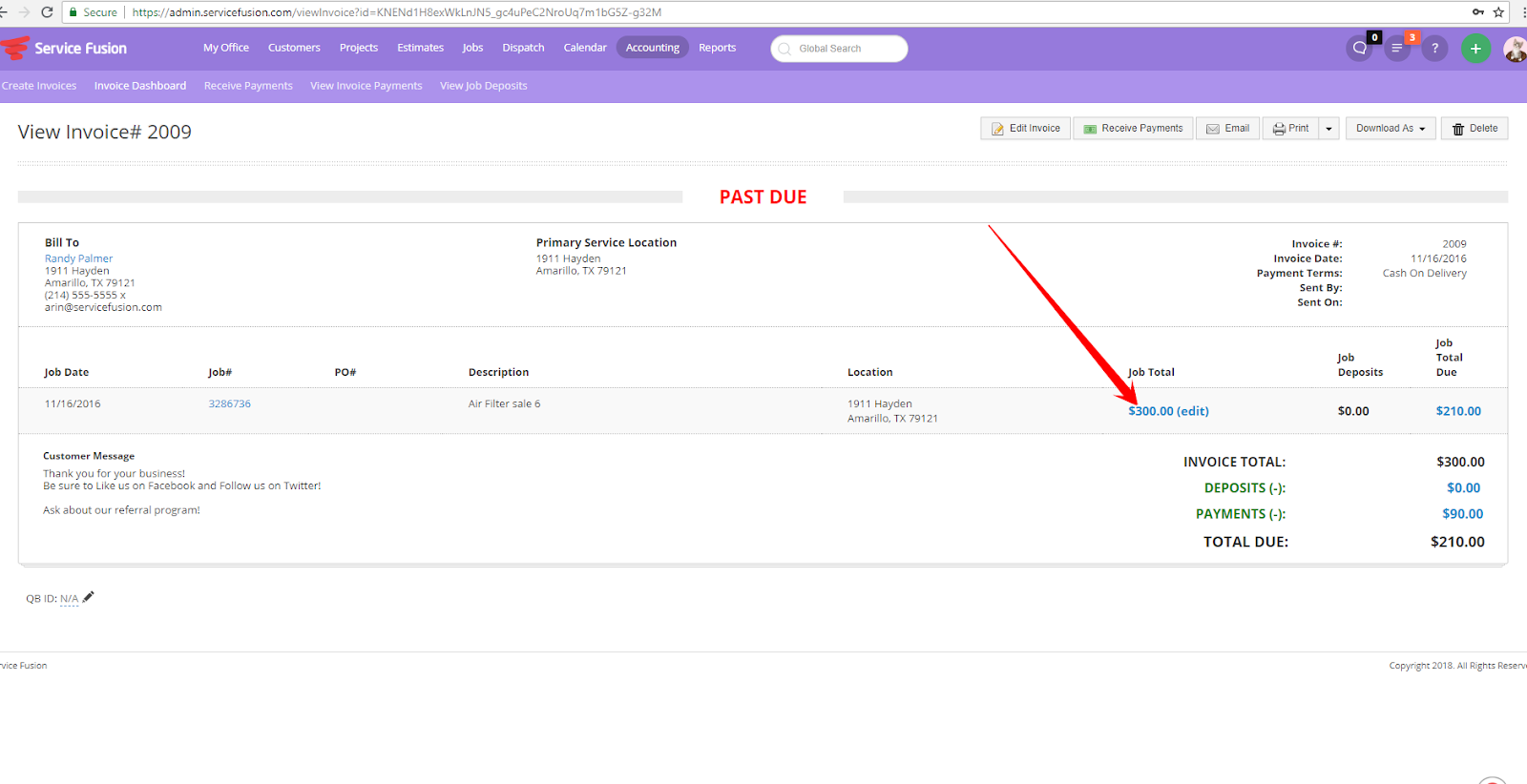

4. ) To write off an invoice, go to the invoice you want to write off. Select the edit button under Job Total. It will be in blue.

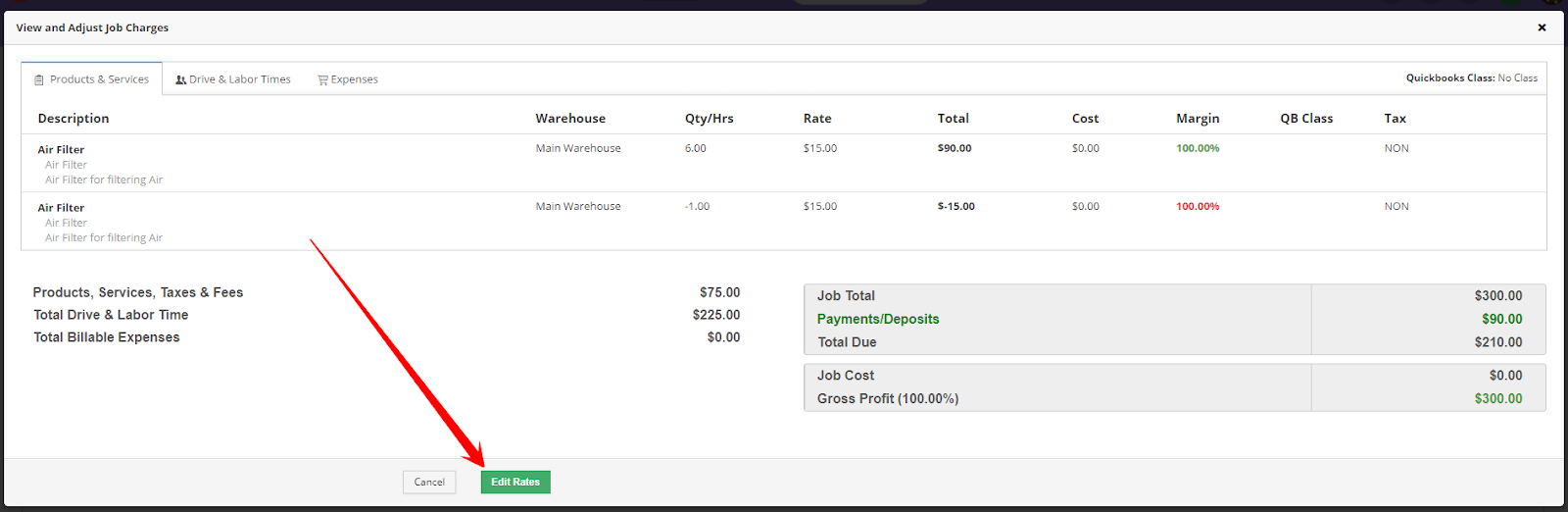

5. ) Select the Edit Rates button.

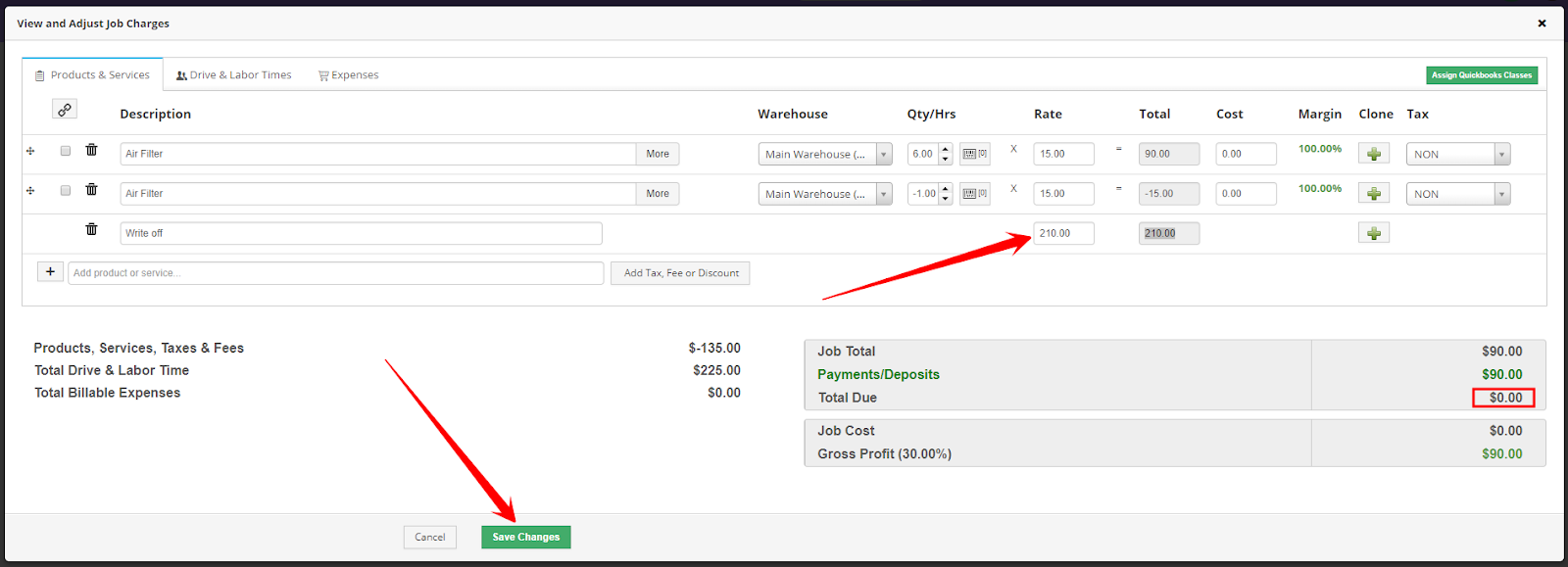

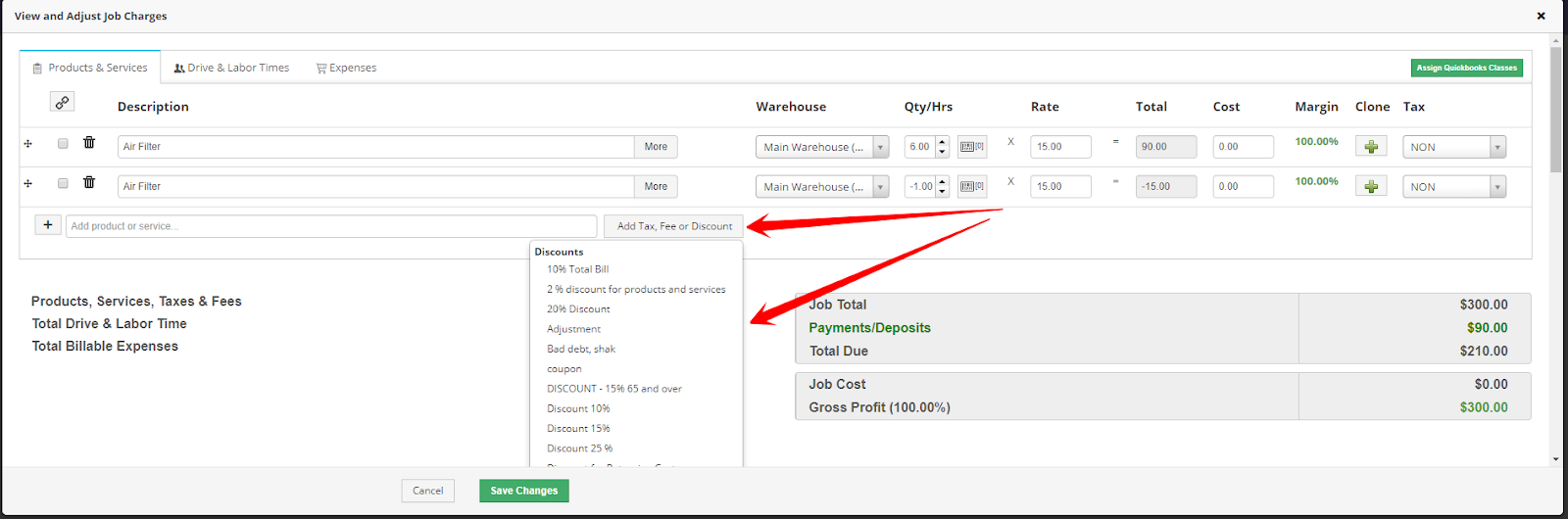

6. ) Select the button, Add Tax, Fee or Discount, and choose the discount for the bad debt or write off whatever it is set up as.

7. ) Put the total amount of the invoice to make it equal zero in the Rate box and tab to get it to go over. Then Save the invoice.