FusionPay fees are assessed per transaction and are automatically deducted from the deposit that you receive into the connected bank account with FusionPay. As a result, the bank deposit that is performed in QuickBooks will need to account for the fees assessed from FusionPay.

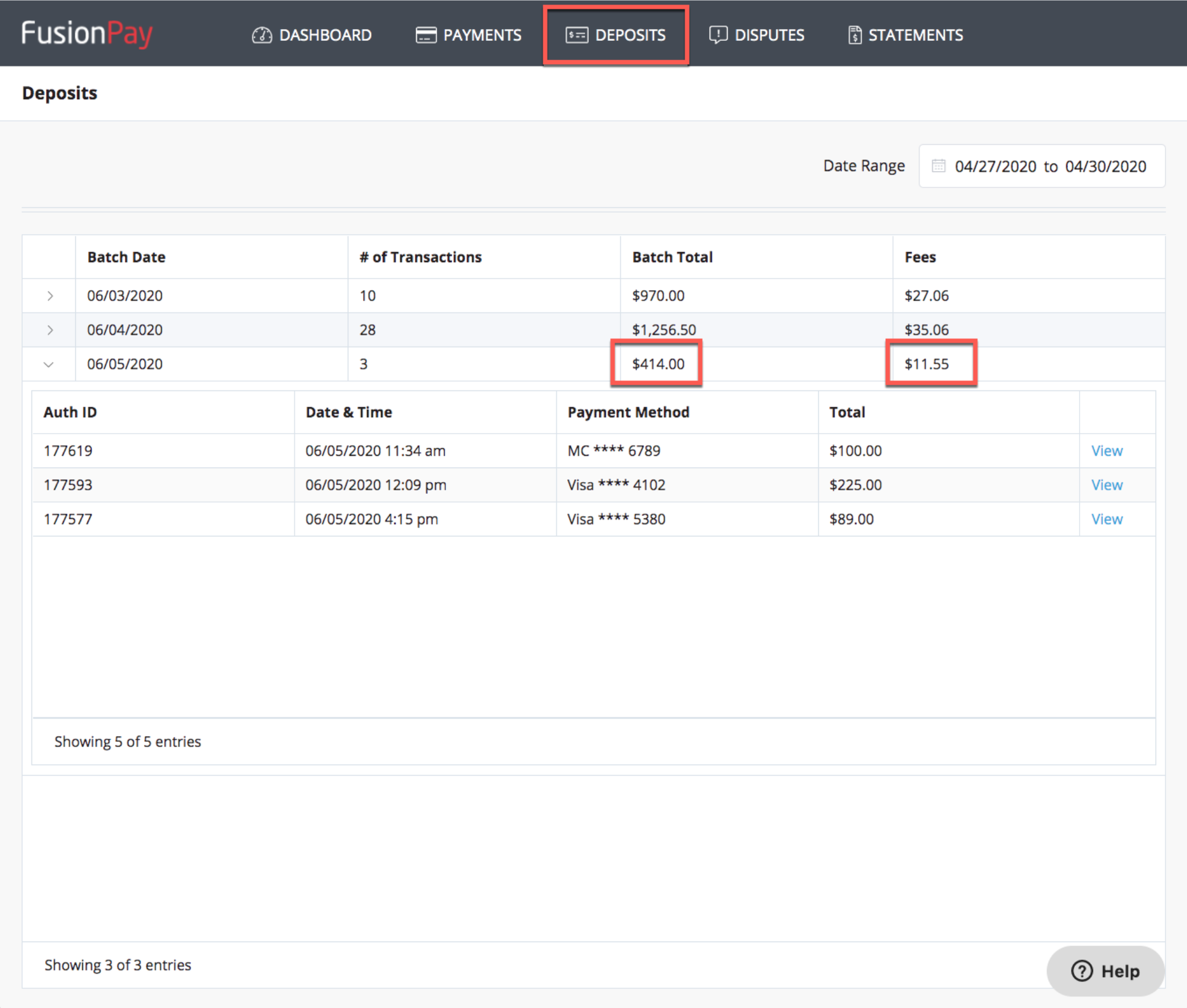

In this example, we receive a FusionPay deposit in the amount of 402.11, as a result of three payment transactions equaling $414.00 and transaction fees. (Batch Total - Transaction Fees = Deposited Amount; 414 - 11.55 = 402.45)

As seen from the FusionPay deposits screen:

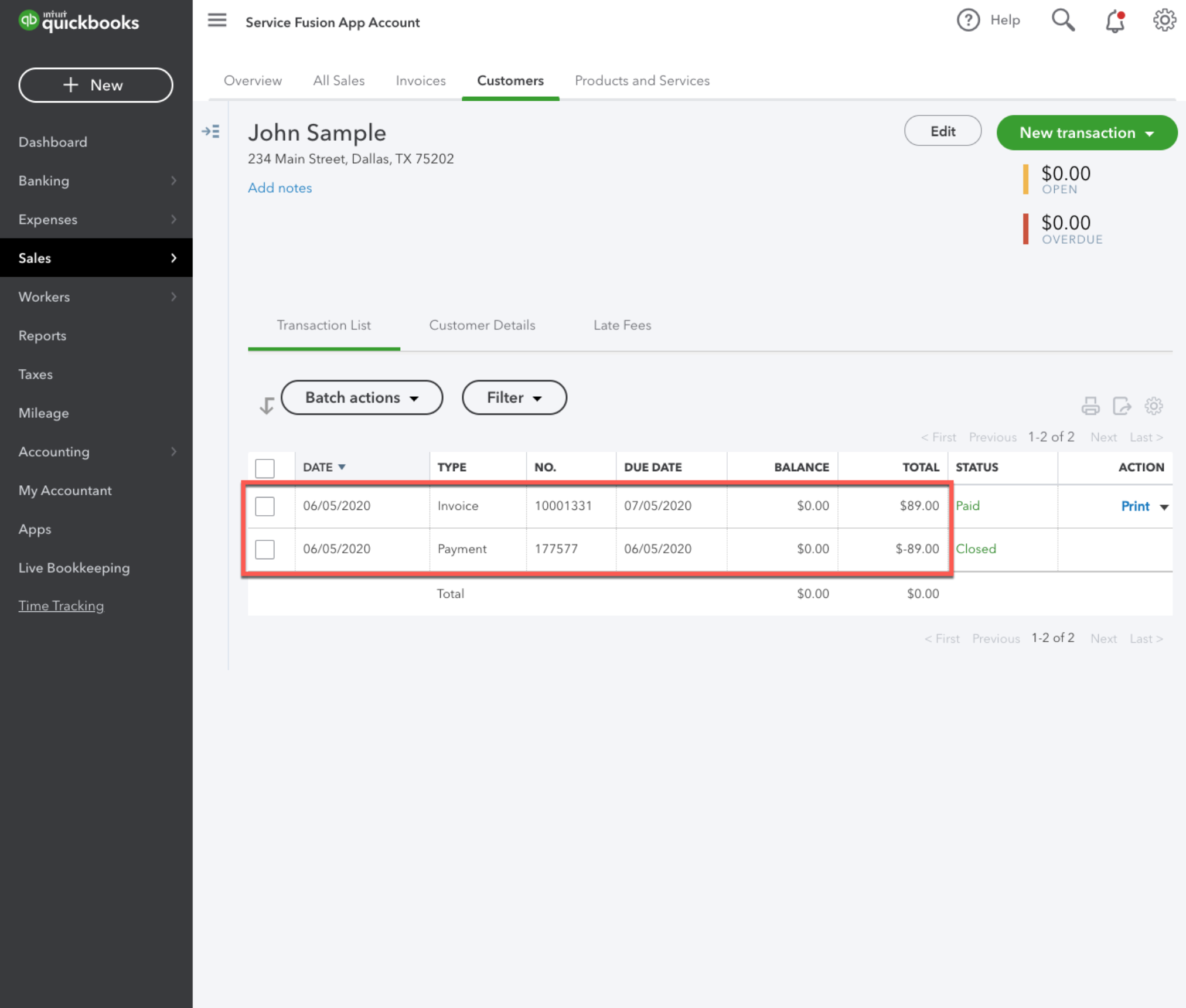

The full payment amounts will be present when syncing to QuickBooks, as seen below The 89.00 payment is synced to QB and received in full:

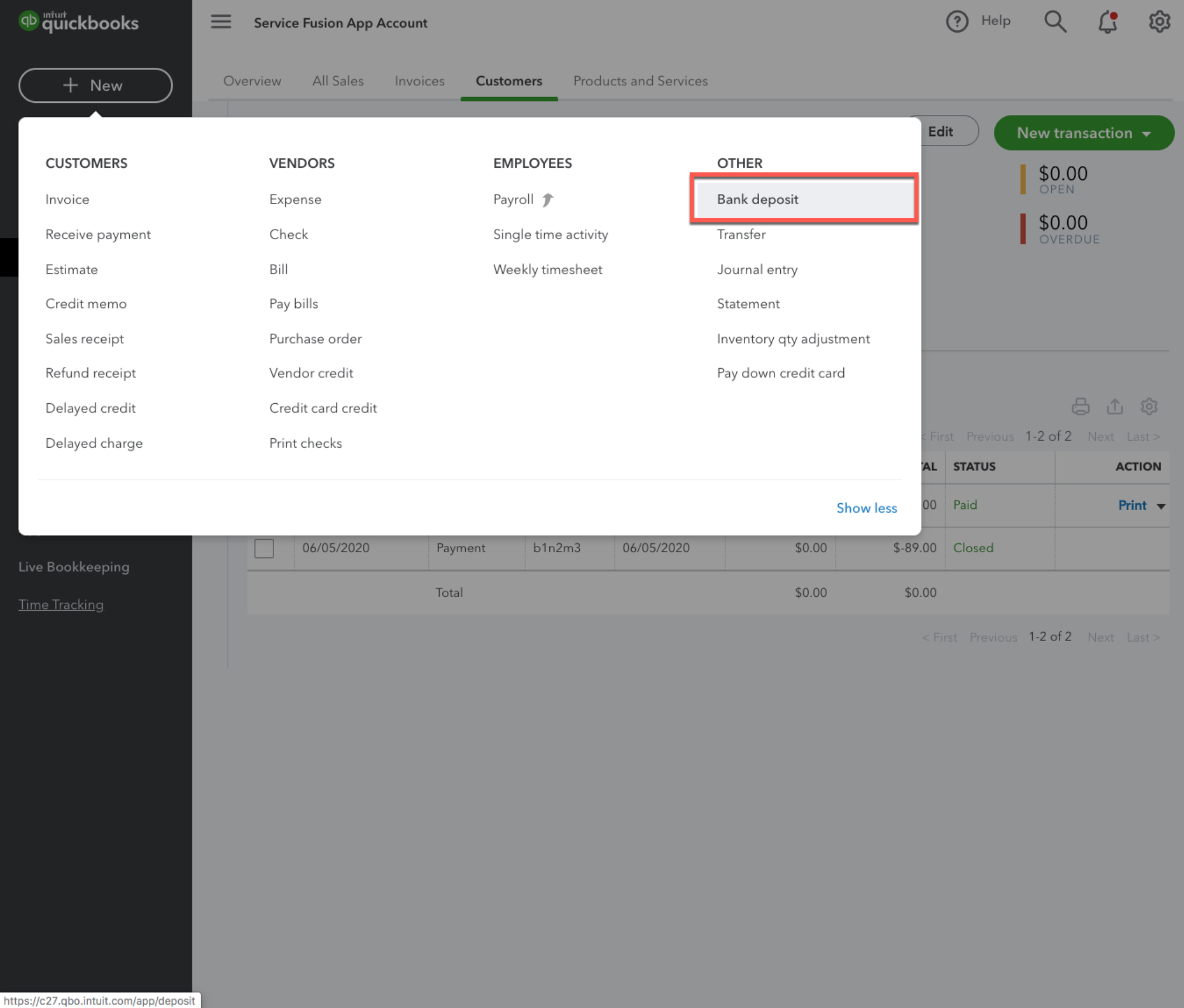

When the deposit is received in FusionPay, we will need to make the corresponding Bank Deposit in QuickBooks. From New, we can select to create a new Bank deposit, as seen below.

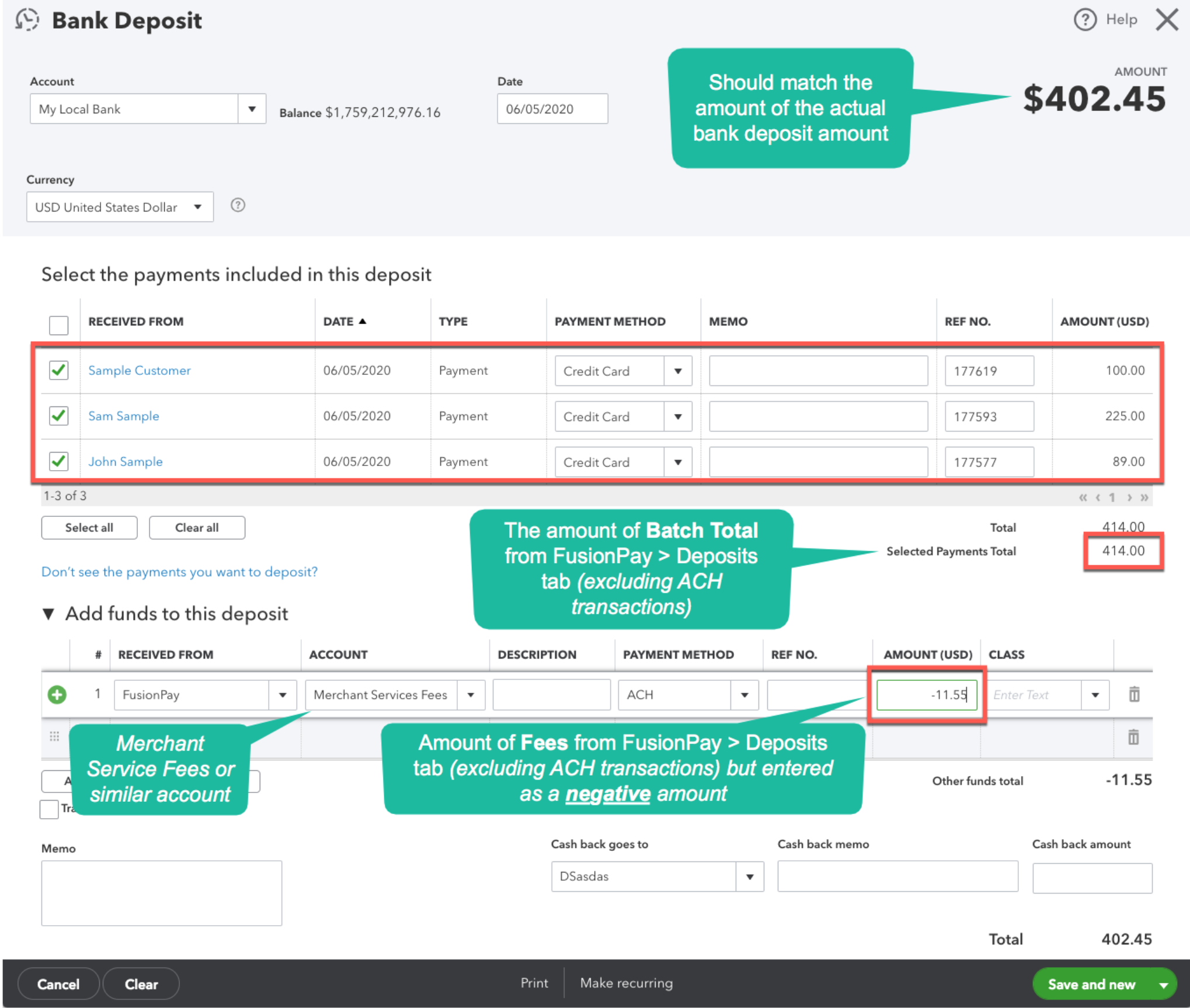

To create a bank deposit in QuickBooks from the FusionPay deposit, this is a three step process:

1. We will need to check the payments that were indicated to belong to the FusionPay deposit, to belong to this bank deposit.

2. We then need to 'add funds to this deposit', and include a line item that will account for the transaction fees from FusionPay, indicate the appropriate values for the 'Received from' as well as the account and payment method.

3. Lastly we need to enter the amount of the fees as indicated from the FusionPay deposit. Please note, this entry is a negative amount entry.

It's important to note that the Bank deposit amount created in QuickBooks will reflect the actual amount deposited from FusionPay. ($402.45)

The 'selected payments total' will equal the amount of fees from FusionPay. ($11.55)

Transaction fees, and possibly a PCI compliance fee, are the only fees that you will pay with FusionPay. There are no additional fees on top of these that will need to be accounted for!